Built on W3C standards and OIDC. Multi-cloud deployment. AI-ready infrastructure.

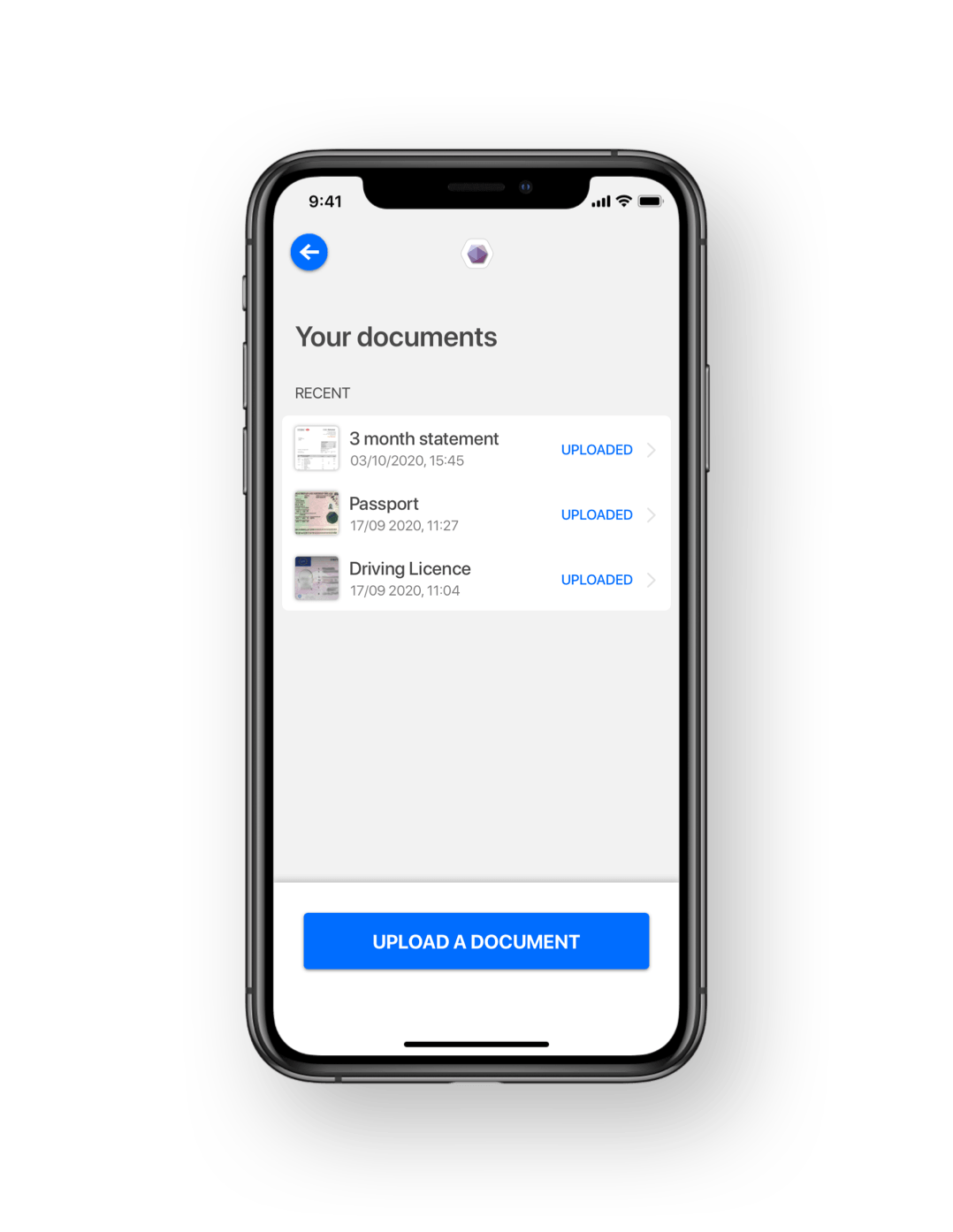

Nuggets Trust Layer provides purpose-built identity infrastructure for AI agents, humans and businesses.

Built on established open standards with bank-grade security, it integrates seamlessly with existing systems and AI protocols.

Available globally across 150+ countries. ISO 27001 certified and enterprise-ready.