The open banking revolution is quickly gathering momentum.

While the transition is likely to increase the operational efficacy of banking and heighten customer experience, it also threatens to expose individuals to privacy and security shortfalls.

With banks required to divulge personal financial information, basic protections can no longer be guaranteed. That's where Nuggets Verified self-sovereign decentralized identities come in.

Security and confidence ensured

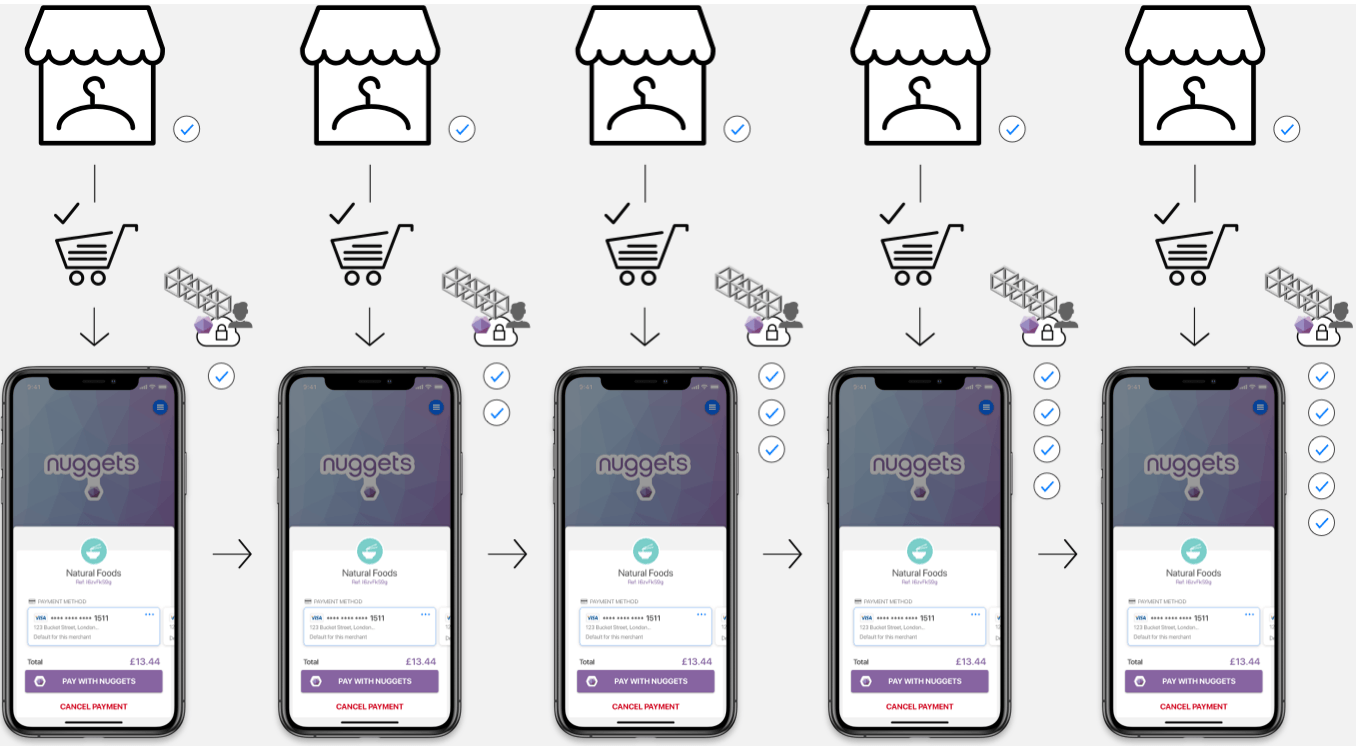

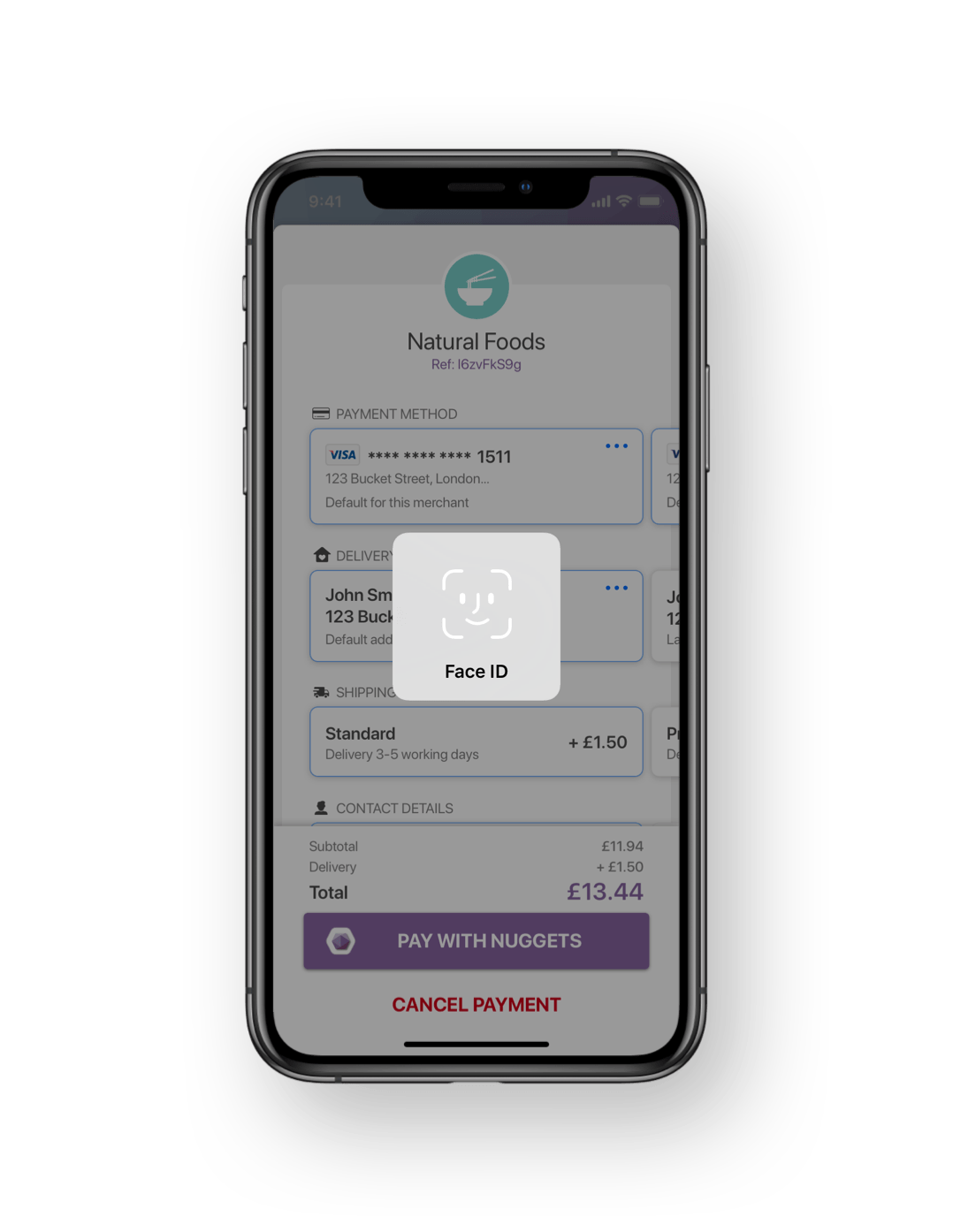

Harnessing our biometrically validated digital IDs underpinned by the immutability of the blockchain and connected to the payment source, not only removes the onus on third party businesses to keep financial data safe, but it can also remove the risk of fraudulent push payments and identity theft.

Rather than using the antiquated username and password combination coupled with insecure SMS and email verifications, customers can frictionlessly tie their Nuggets ID to their bank through apps, platforms, and services—all without intermediaries endangering the customer's privacy and security or indeed that of the bank itself. In turn, the bank can provide the customer with their rightful access to services and products with confidence.

Our digitally verified IDs also help mitigate (even eradicate) push payment fraud. With verified IDs on either side of the transaction, payment requests made outside of the established channels cannot and will not be processed.

Perhaps most importantly, Nuggets IDs ensure that the person who is logging in is the rightful owner and that the service connecting a user to their bank is doing so in a secure environment. This also caps the chance of data breaches with all information cryptographically secured.

Fully customisable. Easy to integrate. Cross-platform.

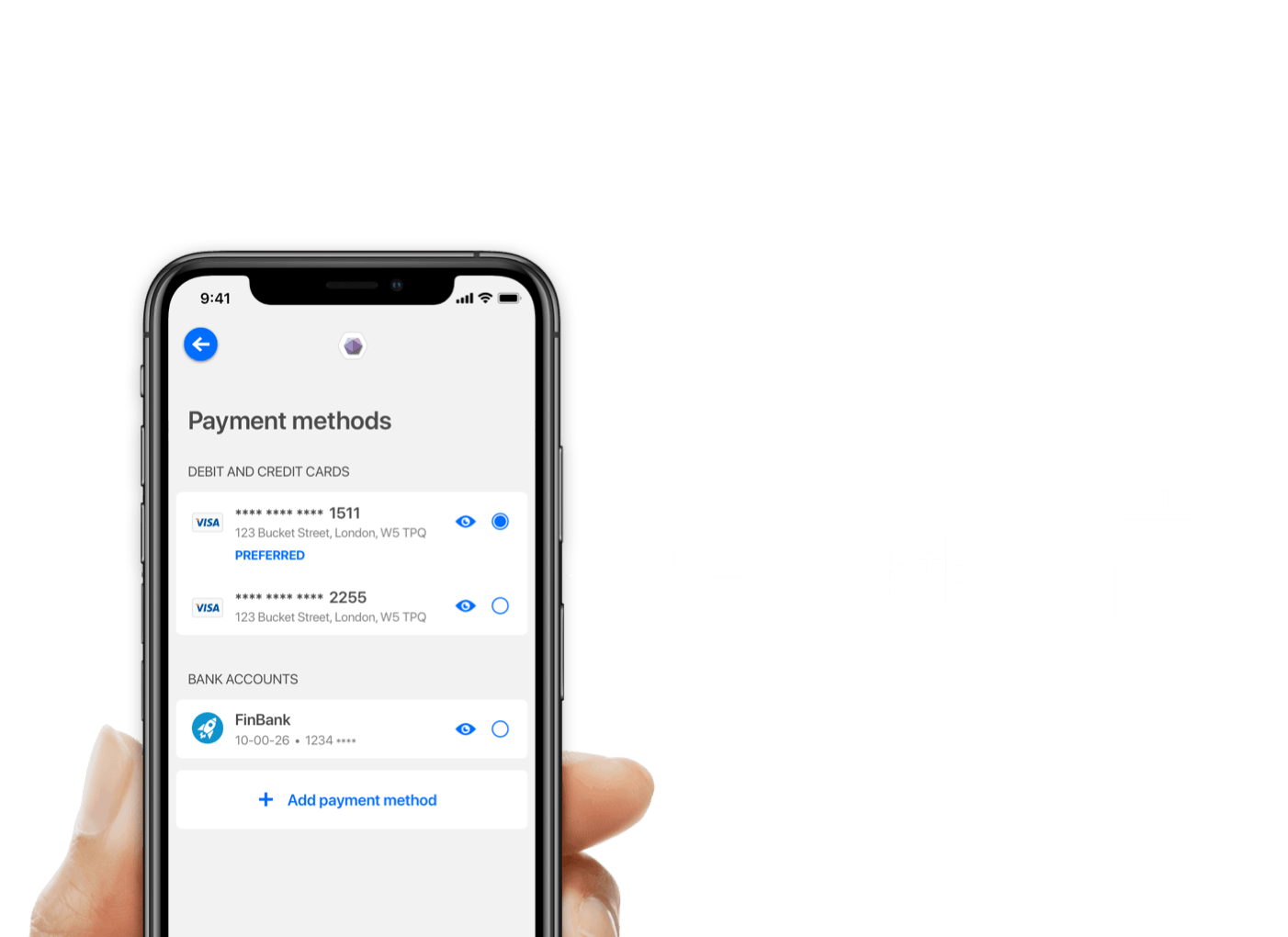

Nuggets is a white-label identity solution. Deploy it the way that makes sense for you and your customers. It integrates with compliance processes, payments and your customer experience.

Consumer-grade and enterprise-ready.

Nuggets is available on Android and iOS, desktop and multiplatform.