Banks

In both consumer and merchant services, Nuggets is invaluable for banks.

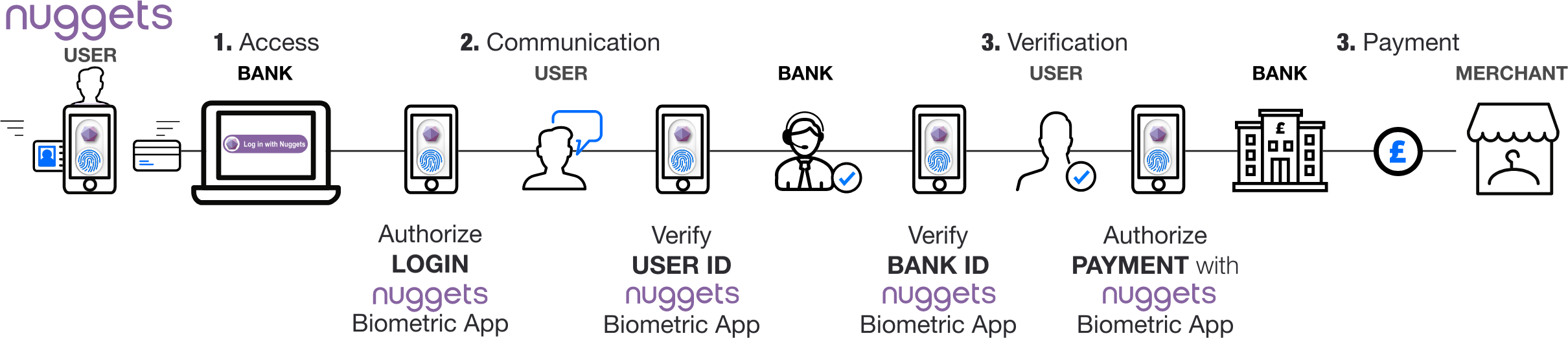

For consumers, we provide secure access, communication, verification and payment. In merchant services, Nuggets delivers extended privacy, security, fraud reduction and Strong Customer Authentication beyond the baseline on every transaction.

example

Modern Banking

Trust – through secure access and communication – is imperative for modern banking. But all too often it’s a one-sided trust customers have no way of proving that the communication really is from their bank.

Combine this with the rise of fraud in the form of push payments, unsecure 2FA, social engineering and identity theft, and it’s clear we need a fundamental change. Nuggets is that change.

The benefits

Nuggets minimises regulatory and reputational risks. It also reduces losses from fraud, false positives and fraudulent chargebacks. And increases revenue. All with the privacy and security of blockchain.

Cut fraud

$24.26 billion lost to card and identity fraud worldwide in 2018

Cut false positives

$331 billion lost or passed up through false positives worldwide in 2018

Cut fraudulent chargebacks

These make up 42% of retail fraud losses

Single sign-on with biometrics

One biometric verification. No more usernames or passwords at any level

Simple, secure payments

Customers can use various methods, including credit and debit cards or cryptocurrency. Without handing over personal data

Loyalty rewards & value

Customers earn rewards and value when they choose to share data with you

More transactions

Trusted and verified transactions mean more payments go through, with more peace of mind for you

Verified two-way communication

Customers can be assured you’re genuine, and can confirm their identity to you

Cross-platform

Available on Android and iOS, and across mobile, desktop and multiplatform

No more risk assessments and credit checks

Nuggets users build up a trusted profile as they complete transactions. This proves they’re good actors in the network, and their payment methods are good

Minimise regulatory and compliance exposure

General Data Protection Regulation (GDPR), Second Payment Services Directive (PSD2), Federal Trade Commission Act (FTC Act) and California Consumer Privacy Act (CCPA)

Simple integration

Easy and secure API and Container integration

Immutable record of transactions, while protecting security and privacy

You no longer have to question or prove transactions

No more insecure 2FA

Do away with weak password, SMS and email verifications

Secure trustless network

All participants are verified, and a reputation network

White label apps and services

Integrate easily with existing products and systems

Contactless delivery, biometrically verified

A courier can deliver a package contact-free, by pinging the customer’s Nuggets app. The customer just verifies their ID biometrically, and confirms the delivery

Digital safety without training

Nuggets is simply safer. And because there are no usernames or passwords, there’s no chance of anyone accidentally compromising them

User owned and controlled documentation

Remove the cost and the responsibility of holding personal data

Modular integration

Verified login, payment or ID

KYC Agnostic

Works with businesses' choice of KYC

End-to-end Encryption

No possibility of a man-in-the-middle attack

Open Standards

Through the use of open standards W3C Verifiable Credentials (VCs), Decentralized Identifiers (DIDs), DIDComm Messaging (DIDComm), Key Event Receipt Infrastructure (KERI). Nuggets truly enables global interoperability as a Self-Sovereign ID (SSI).

Strong Customer Authentication

Verified Identity and Payment for PSD2 Strong Customer Authentication on every transaction, beyond

the baseline

Inherence (something a user is)

Verfied identity and device biometric fingerprint recognition

Possession (something a user possesses)

Verified trusted device, App and identity via ownership of private key signing and verifying

Beyond the baseline

Multi Factor authentication, Private Key, Stored ID elements and Proof of Good Actor on every payment big or small

Fully customisable. Easy to integrate. Cross-platform.

Nuggets is a white-label identity solution. Deploy it the way that makes sense for you and your customers. It integrates with compliance processes, payments and your customer experience.

Consumer-grade and enterprise-ready.

Nuggets is available on Android and iOS, desktop and multiplatform.